Oil services - An overview

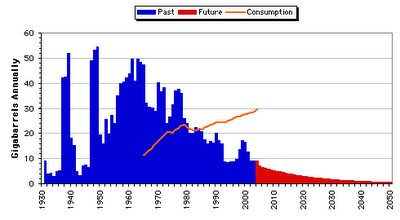

Down Stream services: Conventional oil production in North America peaked, starting with the peaking of oil production in the lower 48 states of USA, followed by Canada and then Mexico recently. Most of the new oil coming online are heavy crude from the oil sands of Canada and the deep waters in the gulf of Mexico. The existing refining facilities are not geared to handle heavy sour crude. Valero has been a big exception. Their success in recent years has been based on its ability to refine cheaper sour crude. Most refineries still need light sweet crude for refining.

This sector is dominated by a handful of giants. In fact, much of the energy industry is ruled by major 'integrated' oil companies. Integrated meaning – these companies do both upstream and downstream side of the business.

Upstream Services : Unlike many people think, oil fields do not resemble an underground lake of dark viscous liquid. Instead, if you were to draw an analogy, oil fields look more like wet sponges. Oil is trapped inside small pores of underground rocks. Porosity of the rock is what determines the amount of oil that can be recovered. As the oil fields age ( most US oil fields are in their twilight), the difficult to reach oil needs to be reached through more well bores both vertical and horizontal. Secondary and tertiary recovery processes needs to be employed. This is where the expertise of oil service companies come handy.

There are two major types of upstream Services - Drilling services and oil field services. Drilling service companies offer their expertise with land rigs, offshore rigs, drill Ships etc. While, the oil field service companies offer services in areas of Seismic testing, Directional Services ( drilling angles ), transport services ( moving rigs ).

In his latest book "The Coming Economic Collapse", Stephen Leeb goes on to say "1970 to 1980, oil service company shares rose more than twenty-fold, almost exactly matching the gains in oil itself. Similarly, during the initial stage of the current bull market - from the end of 1998 to August 2000, when oil prices climbed threefold before reaching an interim peak - the gains in oil service companies nearly equaled those of oil. We conclude that, in bull markets, oil service companies typically rise as much as oil".

As the price of oil increases, with declining production from aging fields, it becomes critical to squeeze out every possible drop of oil from these fields. This is where the expertise of these service companies become invaluable. Engineering services depend on highly skilled man power. Years of engineering expertise that these firms and their talent pool provide, will not be replaced in the marketplace overnight. Majors and independent producers will be paying top dollar for the services offered by these service firms.

As civilization goes on its quest for more oil, service companies that provides expertise in areas of deep water drilling, oil sand upgrading and heavy crude refining might see some of the biggest growth, in the coming years.

© 2006 Oil Shock for TheViewFromThePeak.com

Disclaimer : Oil Shock is neither a petroleum engineer nor an oil industry insider. If any of the information provided in the above write up is wrong, any one is welcome to post their comments.